Liberal democracy, the defining mythos of the United States, is collapsing. What is the root cause of this collapse and how should we respond?

Most on the left attribute it to the ‘mode of production’ we call ‘capitalism’ but I don’t see that as helpful. This is because it needlessly complicates what is essentially a simple picture and leads us to solutions that fail to target the essential issue. The sickness is far simpler than most Marxists lead us to believe. The problem isn’t the mode of production per se nor is it ‘economic’; the problem is political to its core and we can find it in the oxymoronic term ‘liberal democracy’.

Merriam Webster defines ‘oxymoronic’ as ‘a combination of contradictory or incongruous words (such as cruel kindness)’. Liberal democracy IS cruel kindness, or more exactly cruelty propagandistically disguised as kindness. It is the anti-democratically cruel rule of wealth disguised as kind democracy.

It’s the incongruence of this oxymoron that drives our historic collapse. Society can’t survive and will ultimately always collapse if it’s ruled by and for the interests of a tiny minority and this is so even if there exists formally democratic elements. The root problem in other words is the depravity of power—the cruelty—that is always the essence of material inequality. This is a very old problem going back thousands of years to the very beginnings of civilization.

What then should the left propose as a solution? The standard Marxist answer is socialism but this is too vague. It’s a ‘mode of production’ / economic answer that makes sense only if the root problem is in fact a mode of production. But isn’t socialism by definition egalitarian? No. Except for a vision of utopian communism in the far-off future, many and perhaps most socialists either support the continuance of some level of inequality or ignore it as irrelevant to what they insist is the prime issue—the mode of production.

But inequality is of fundamental relevance because that is what the problem is. The problem, restated, is class society and you can’t eliminate class by simply defining it away in mode of production terms. A society with inequality of income or wealth is a class society by any reasonable definition. Imagine a new socialist mode of production entailing just two proletarian groups, one making twice the income of the other. The mode of production called capitalism has been overthrown but this new world in my view is clearly unjust and unstable. Not only that, both history and the logic of power suggest even small inequalities quickly institutionalize and become just another version of the same old pattern.

The final few decades of our collapsing ‘liberal democracy’ is widely called ‘neo-liberalism’ which aptly highlights the driving cruel element in the oxymoronic term. The left should focus now on applying the neo to the democracy element and initiate a fundamentally new era of humanity—neo-democracy. An egalitarian democracy rooted in equality, sustainability, cooperation, and collective prosperity. The vision first and then the mode of production.

The Deficit Myth, one of the great foundations of anti-population oligarchic ideology and the title of Stephanie Kelton’s new book, has been teetering of late and will hopefully soon collapse. MMT deserves much credit for this important achievement, but in this post I’d like to argue that the popular presentation of the ‘deficit myth’ over-emphasizes the desirability of deficits at the expense of the far more desirable taxation of the rich.

The take-away, I think, should be that progressives should demand balanced budgets almost all the time, not because of false concepts of debt, but because of the need to reduce and eventually eliminate the undemocratic power of unequal wealth.

As we know from both MMT and Kalecki’s profit equation (Profit = Capitalist Spending + Deficits), government deficits flow directly to profit.

This is a crucial bit of information because it directly confronts another oligarchic ideology we could call ‘The Tax Myth’. The tax myth argues there’s a tight economic and moral limit to how much the rich should be taxed. A key way of sustaining this myth is by ignoring the deficit-profit equality. While MMT shows this link to be true, it doesn’t publicly highlight it to anywhere near the same degree as it does the deficit myth. Thus the title of Kelton’s book. But with the deficit myth collapsing, it’s time for the Left to direct its attention to the tax myth.

Suppose as president you were sitting in a boardroom with the executive committee of the oligarchy. You point out there is unemployment, poverty, and unused resources in the country and you ask, as owners of the means of production, if they would be kind enough to bring them online promising they would incur no cost for doing so. Would it be reasonable for them to refuse and insist instead that not only should it be costless to them, but that they should receive compensation equal to 100% of whatever is spent? I think not but that is exactly what happens with deficit spending.

Let’s look at a simple example.

Assume annual capitalist profit (which includes interest, rent, dividends, and other such items) before any new government spending amounts to $5 trillion and the existing tax rate on it is 20%. After tax income to the class is thus $4 trillion. The government then decides to spend $3 trillion for social purposes. Before tax income for the capitalist class thus rises to $8t and if it isn’t taxed for this, its after tax income at a 20% tax rate would rise to $6.4t.

If we are to keep the after tax income of the capitalist class at the same $4t level it was before the government spending, then the tax rate would be increased to 50%.

Of course the oligarchy, citing the tax myth, will adamantly argue this is an outrageous ‘soaking of the rich’ and a gigantic unfair burden but how exactly is this so given that the after tax income for the class remains exactly where it was before? It will also argue that such tax rates would discourage investment but this also is bogus given that the greater income in the system will make investments far less risky.

It’s humorously counterintuitive that the main conclusion from the deficit myth is that we should demand balanced budgets!

(PS: As an aside, it’s helpful to note that the initial assumptions above already bring to bear the tax myth since the initial pre-tax $5t of capitalist income included pre-existing government spending of 20% which was then taxed away. Restated, pre-government spending capitalist income was $4t, government spending was $1t which flowed to pre-tax income and was then taxed away. A key take-away from the tax myth is therefore that the rich aren’t taxed at all!)

Financial Times associate editor and CNN global economic analyst Rana Foroohar, a well-placed democrat, gives us a helpful foretaste today of the “Biden plan” which she applauds as a “no-brainer”. It’s entitled ‘A Blueprint for America’s Recovery”. We should brace ourselves for a great many of these unpleasant kinds of articles as we ever so tentatively prepare to make the turn from Trumpian neo-fascist Republicanism to a reinvigorated rhetorically adjusted neoliberal ‘centrism’.

The article begins by making a number of faux criticisms of “neoliberalism”, a smart tactic given how unpopular the term has become. But it’s only rhetoric for what is laid out is the same old competition state ideas that have always been the foundation of the global neoliberal system. It’s the proposition that workers must forever compete in a global economic contest and that the government’s role is to invest in the basic infrastructure and scientific research that helps them do so.

That competition state neoliberalism is somehow a natural and reasonable foundation for the economy is a grotesquely false mythology that serves only to justify an inhuman exploitative system that cannot possibly foster widespread peace and prosperity. In its logic, every worker becomes a mere competitive cog, a living particle in the great global elite power machine. It’s pure ‘disinformation’ (to use current terminology) that should summarily be rejected. Why would anyone suggest the living standards of Americans be subjected to competition with the Chinese or other foreign workers when we and they already have more than enough productive capacity and technology to live very well? To be clear, my question isn’t whether or not we should close our borders (we shouldn’t), it’s that we should cooperate rather than compete.

We have “serious work at home”, the writer says in developing the argument, and “Mr. Biden should be frank with the American people and say what we already know in our gut to be true”. And here are the gut truths: education isn’t keeping pace with technology, US healthcare is costly and inefficient, and roads, bridges and broadband need upgrading.

The problem with these banalities isn’t that they aren’t necessarily true in and of themselves, it’s the competition state logic she uses to support public spending on them. The argument isn’t that education, healthcare and infrastructure are in themselves valuable for our lives which of course they are, it’s that investing “in all of this is smart, because it would increase the value of human capital—the key resource of the 21st century economy”. Such is the thinking of the neoliberal mind. We don’t work to make our standard of living better, we work because we are human capital machines. And to further cement the case, the writer follows with this gem: “Companies should be able to depreciate investment in people as well as machines, as they do now”. Yes, in a Biden administration human capital machines will be depreciable!

And so it goes. Public debt matters and private austerity and GDP growth is the way to reduce it. Low interest rates are bad. And, finally, the government should underwrite “basic research in high growth technologies such as clean energy, quantum computing, and artificial intelligence”. As if our standard of living is hurting because we lack quantum computing and artificial intelligence.

I’ll stop here but be forewarned dear reader, this is what we have in store if Trump (hopefully) loses. It’s the no-brainer Biden plan, a blueprint for America’s recovery, and it makes crystal clear why it was that Trump was a no-brainer for so many hurting Americans back in 2016.

Any socioeconomic system in which a tiny minority owns or controls essentially all material power is by its nature hostile and unstable. It’s an indelible link and cannot be otherwise. This instability plays out on two different axes: one being the relationship between the propertied minority and the propertyless majority (call it the population axis) and the other being within the minority class itself which perpetually fights for its share of power (call it the oligarchy axis).

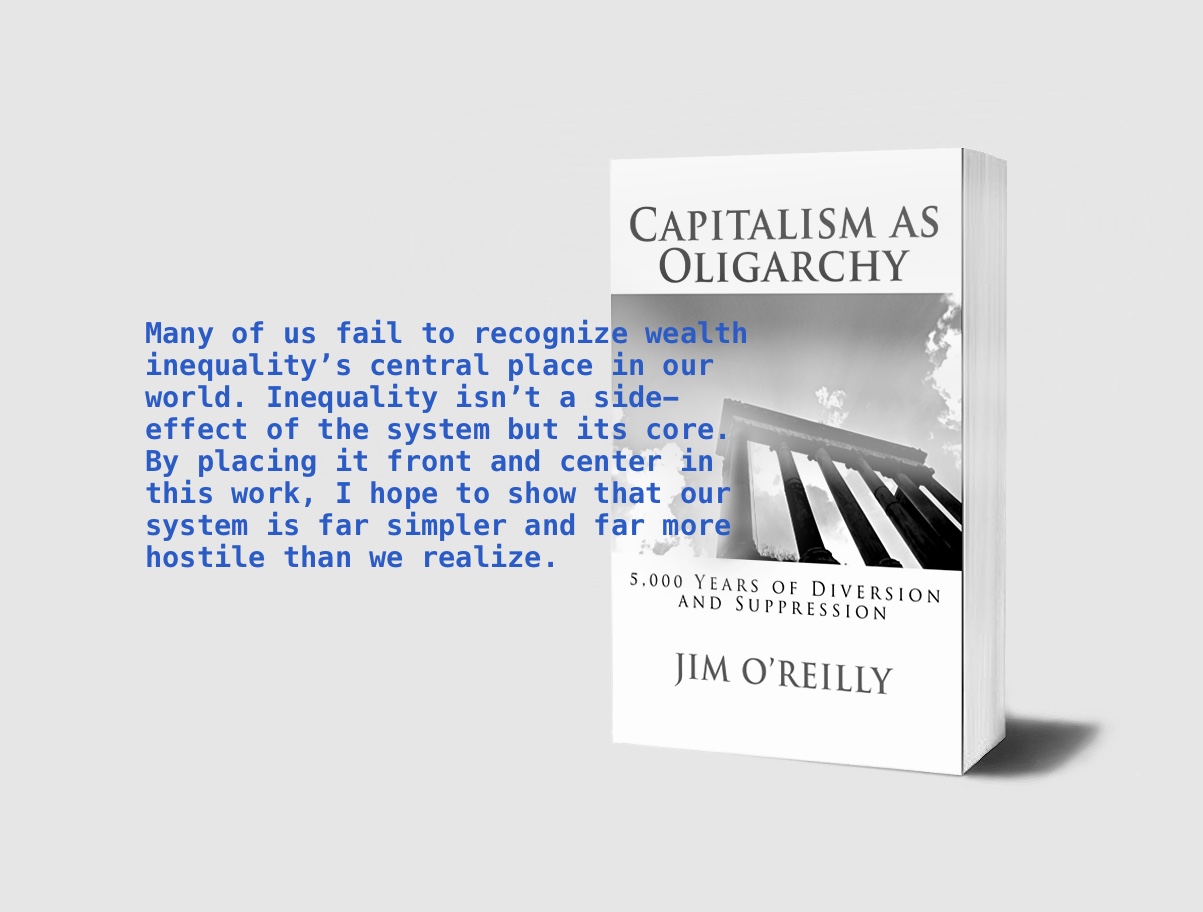

Minority power in this sense, regardless of its many possible mutations, can and I believe must be viewed as a single systemic type which, as noted in my book and following Jeffrey Winters, I have chosen to call oligarchy. Its opposite is equality/egalitarianism. The entire 5,000 years of recorded civilization right down to the present day, with all its wars, power concentrations, mass exploitations, and majority suppressions is that of the former while the preceding hundreds of thousands if not millions of years of human evolution before that is of the latter. This represents the most fundamental divide in human social history and is the absolute foundational divide in politics.

The past couple hundred years mark a distinct phase of the 5,000-year oligarchic system and we commonly refer to it as ‘capitalism’. This is a problematic term, however, as it wrongly elevates ‘capitalism’ as the primary system and demotes what actually IS the system–minority power (inequality/oligarchy) to a mere side-effect of it. Our discourse thereby becomes confused. As just one of many possible examples, we have the likes of Elizabeth Warren who can within center-left circles safely proclaim she’s a capitalist to her bones without implying anything particular about inequality, supporting the status quo without admitting what it actually is. Could she safely say she was an oligarch to her bones? I think not.

I want to focus today on the hostile instability of this ‘capitalist’ phase of oligarchy and how its broad historical development can help us see where we’re situated today, a few days before the 2020 US presidential election. I believe it can shed a great deal of light.

I noted about seven years ago in this blog that extreme outbreaks of instability seem to occur in a cyclic way. I think it’s important to revisit this topic now because 1) developments in the world are warning, more than at any point in my lifetime, that we’re heading toward a major crisis AND 2) the 2020’s happen to be where the next cycle point would hit if it continues its past dynamics.

The instability cycle I refer to is roughly 60 years and always seems to involve in one way or another both the population and the oligarchic relationship axes. Let’s look briefly at this long cycle.

I begin with the French Revolution in 1789 which opened a 25-year period of extended war in Europe lasting until 1814. France and the French Revolution, particularly its Jacobin phase with its liberté, égalité, fraternité, is widely seen to this very day as the key inspiration for populist revolt against undemocratic power.

Fifty-nine years after 1789, we find the cataclysmic explosion of 1848, the first revolution in modern European history and the widest. According to historian Eric Hobsbawm, no revolution spread more rapidly, “running like a brushfire across frontiers, countries and even oceans.” Within weeks, no government was left standing in all or part of today’s France, Germany, Austria, Italy, the Czech Republic, Hungary, Poland, the former Yugoslavian nations, Rumania and parts of Latin America. All were “in fact, or immediate anticipation, social revolutions of the labouring poor.” The revolution quickly failed as the original governments were able to retake power within a few months but the events demonstrated an extremely dangerous “romantic-utopian” atmosphere, a “springtime of the peoples.” The US Civil War began just 12 years later.

The next cycle point is in 66 years with the explosion in 1914 of World War I, followed by the Russian Revolution and 30 years of war, chaos, and depression. Communist regimes eventually came to rule over substantial percentages of the global population and the anti-oligarchic ideology represented a clear and considerable systemic threat.

Finally, 54 years after 1914, we witness the outbreak and instability of the 1960s and 1970s, using 1968 as the specific date. On the population axis, we see the height of the protest movements in the US, France, Germany, and elsewhere. The May 1968 uprising in Paris drew inspiration from the French Revolution and appeared close to overthrowing the conservative de Gaulle government. The decade was marked by dramatic attacks on the oligarchic status quo, including the Civil Rights movement, Woodstock, the broad countercultural movement and so on. It also saw the top popular leaders in the US, John Kennedy, Robert Kennedy and Martin Luther King, assassinated. The Cultural Revolution in China began in 1966. The US war on Vietnam and its broader ‘Cold War’ against communism lies on both axes: suppressing populations in favor of ‘capitalism’ (oligarchy) and an inter-oligarchic fight for American supremacy over rival national oligarchs.

That brings us to today. If the cycle holds, the next instability point will be between 2022 (54 years) and 2034 (66 years). I think it will hold.

All past cycle points were the inevitable explosions arising from the ever-building pressures that were only momentarily and inadequately mitigated in the previous cycle. It’s in the nature of oligarchy that things can’t fundamentally change. Dangerous pressures can never be eliminated, only delayed. In the words of the great Italian writer Giuseppe Tomasi di Lampedusa, “everything needs to change, so everything can stay the same”.

The many pressures from 1968 were temporarily relieved by, among other events, the ending of the Vietnam War and the passing of civil rights legislation. But what followed was an intensification of a soulless consumer culture, the Reagan/Thatcher attack on unions, wages, job security, and population welfare programs, and the general subjugation of populations around the world to the laissez-faire economic policies that have come to be called neoliberalism.

Oligarchic greed and lust for power has caused the system throughout this cycle to bounce from crisis to crisis like some drunkard on a ship deck. The seventies saw a bubble in bank loans to Latin American countries leading to a massive debt and foreign exchange crisis in the early eighties. In the latter eighties, we witnessed the gigantic bubble in Japanese real estate and stocks and the failure of thousands of US savings and loans. The early nineties brought us the collapse of the junk bond market with losses (and gains to some) of over $100 billion along with the British exchange rate crisis of 1992 involving speculative attacks against the pound. Speculative fever in real estate and stock prices in Thailand, Indonesia, and other Asian countries took off with stock prices doubling in 1993, leading ultimately to the Asian Crisis of 1997 and the related currency crashes in Russia and Brazil. The Mexican peso crashed by more than half versus the dollar in the 1994-95 crisis leading to the collapse of almost all its banks. The close of the twentieth century brought us the crash of the US stock bubble concentrated in the information technology and dot.com sectors. Massive accounting fraud was exposed in a number of large multinational corporations (Enron, WorldCom, Global Crossing, and so on) in the early years of the twenty-first century. And of course, the subprime mortgage collapse of 2007 replete with widespread fraud among mortgage banking firms, investment banks, and rating agencies, is still even to this day working its way through the global political economy. Austerity for populations and bailouts for the oligarchs has been the consistent theme.

Center-left parties throughout the world, buoyed by the collapse of communism in the Soviet Union and China, stopped all pretense of representing their populations and, under the banner of centrism, the Third Way, and the Washington Consensus became active oligarchic agents on a scale that would have been impossible in most of the previous cycle. The Democratic Party in the US led the way in the population attack with both Bill Clinton and Barack Obama offering no meaningful relief. Oligarchic power as measured by wealth inequality has increased to levels unseen in a hundred years.

Systemic pressures are thus building to levels which seem as high or even higher than any previous cycle point.

And here we are in 2020 suffering under a pandemic and seeing yet again bailouts for the oligarchy and insufficient protections for the population. And on top of it all, we have the intensifying global warming crisis which cannot be adequately addressed without a significant move toward anti-oligarchic collectivization.

An explosion is coming. The system simply can’t continue as is. Evidence is everywhere—the Arab Spring, Occupy Wall Street, the Spanish M-15 protests, rising global neo-fascism, growing popularity of socialism among the young, the Sanders movement, and the massive global Black Lives Matter protests. Inter-oligarchic war in the Middle East is unending and we’re increasingly threatened with the cataclysm of war between the US, China, and Russia.

But the US presidential election, a choice between neo-fascist Donald Trump and ‘centrist’ Joe Biden, offers no release. Another four years of Trump would be an unmitigated disaster as the progressive Left would then face a near fascist police state which would be extraordinarily difficult to overcome. On the other hand, Biden offers absolutely nothing but a continuance of the ‘centrist’ policies which brought us to this situation in the first place, perhaps minimally modified to temporarily relieve a bit of the pressure.

I voted yesterday for Biden with the belief that Democratic Party ‘centrism’ is an easier enemy to defeat than police state neo-fascism. But the important thing in my mind, assuming he wins, is that the Left must expose ‘centrism’ as the existential enemy it is, perhaps the most effective ideological front for inequality. It must immediately and perpetually attack it from every possible egalitarian angle.

The hope is to peacefully abolish, right here and now in the 2020’s, the dismal ever-repeating cycles of ‘capitalist’ oligarchy and move finally toward a second egalitarian age.

Suppose China, Russia, Iran, North Korea, and every other country in the world went to the United Nations and offered to substantially and verifiably disarm. Nuclear and non-nuclear weapons, tanks, planes, ships, armies, everything that could be a threat to another country, keeping only the bare minimum needed for the legitimate defense of their national borders. The proposal would be contingent on the United States doing the same. Putting aside the complex details and the exact methods that would be needed for ongoing verification, should the US in principle go along? If no, then why not? If yes, then why doesn’t the US make this proposal today?

I don’t think there’s any political question more important than this yet we never hear it posed. On the contrary, we’re perpetually bombarded with an endless bipartisan discourse telling us we need to forever spend hundreds of billions of dollars on the military to protect against the coming ‘great power’ contest with China and Russia and, more generally, to ‘prepare for the wars of the 21st century’.

This is simply ludicrous. The very idea of war with countries like China and Russia is crazy for it poses the real possibility, indeed probability, of a catastrophe on the scale of what happened to the dinosaurs. We also know from the results of military war games that the US consistently loses wars with Russia and China and that they quickly escalate to nuclear exchanges. That the US would not ‘win’ such a war is historically self-evident as well given its abject failure in its past adventures with the poor under-developed countries of North Korea, Vietnam, Afghanistan, and Iraq. We (and others) seem addicted to the manly power game of nationalist military adventure but it’s nothing but an outlandishly dangerous and wasteful relic of the pre-20th century world. We need to move on–have we learned nothing from World Wars I and II?

Given the absence of a US proposal, I think we can safely assume the answer to the opening question will be no. But this puts defenders of the US superpower state in an awkward position for it’s extremely difficult (impossible) to come up with a civilized reason for maintaining such power in the absence of a threat.

Beyond the immeasurable benefits of a peaceful world, the average American would enormously gain by redirecting US spending from the military to normal civilian purposes. Imagine if the current $700+ billion military budget were slashed to perhaps the $20 billion or less range that would be justified by the actual defense needs existing in a disarmed world, with the savings then put to building a prosperous country.

I think we should all ask our elected officials and candidates for office why we aren’t pushing for global disarmament?

Progressives in the United States are near unanimous in their support of Bernie Sanders’s calls for a $15 minimum wage and a $60,000 minimum pay for teachers. Taken in isolation, these both seem unobjectionable steps in the right direction and they raise no apparent ethical concerns. But this, in fact, is not really the case. When we place them side by side, we find that they expose important unaddressed questions on inequality.

The Sanders left too often (always) frames its inequality discourse in the negative–wealth and income concentrations at the top are grotesque and need to be reduced. Or income at the very bottom needs to go up. But we never get a positive framing that tells us what inequality level we should actually strive for.

A $15 wage at eight hours a day, 40 hours per week, 52 weeks per year comes to $31,200. This yields a nearly 2 to 1 differential in living standards in which one class–‘Walmart workers’–subsist on half the income of entry level teachers. I find this large differential in life quality, security, and inevitable sense of self-worth to be highly objectionable from a social justice perspective.

Suppose we were anthropologists and stumbled upon a society comprised only of teachers and ‘Walmart workers’ stratified in this way–what would we call it? I can think of a few possible names, but none would be ‘Democratic Socialism’. And no matter what we named it, we could confidently predict that such a society would be destined to instability and eventual effective tyranny. This is because hierarchies of income and wealth–for that is what inequality is–are hierarchies of power. Power corrupts and power perpetually and existentially seeks to suppress the majority.

That we can reach such a conclusion from the seemingly unrelated and innocuous issues of minimum wage and teacher pay shows how deeply embedded inequality is within our political system and also how important it is to present the problem and the solution in a positive differential way.

I think an effective means of arguing against inequality would be to start at the differential extreme, get agreement at that level, and then proceed downward. Working with the recent inequality report of Thomas Piketty et al (page 80 table 2.4.1), we find that the annual after tax income of the top .001% of US adults averages $90,826,000 or almost 3,000 times the $15 wage. Nearly everyone will agree this is grotesque as they will also to the 1,000 times level of $31,200,000. How about 100 times or $3,120,000? Here too I don’t think it would be a Herculean task to convince a large majority that no one should have this level of power in a fair and prosperous society. Let’s proceed downward then to the entry level for the top 10%–$113,000–which equates to a differential of 3.6. A full 90% of the adult population makes less than this amount which to be clear is after tax per adult, not per family. I think this general level of about 4 times the minimum could be a politically achievable but highy progressive starting point. But even if it were 10 times higher, over $1 million a year or 40 times the minimum, we would still gain substantially in forcing the conversation to what the maximum income differential should be while simultaneously wiping out the most concentrated power in our society. Of course there are many details that need to be covered in such a grand re-structuring and there are the standard age-old arguments for maintaining the unequal status quo. I will cover some of these in upcoming posts. But come on! We need to stop beating around the bush on this issue.

Inequality is the fundamental problem not only of our time but of the entire 5,000 year history of civilization and it represents a grotesque corruption of human freedom. It’s time to put it to an end. While we can properly credit Sanders for making inequality a front and center issue, I think progressives need to offer a far stronger critique on the tight limits of his vision.

It’s impossible to understand today’s political dynamic without beginning with the core fact that we live in a class society. For the entire 5,000 year history of civilization, the propertied few have possessed nearly all material power and have thereby ruled over the propertyless majority. So it was thousands of years ago and, crucially, so it remains today.

While this massive asymmetry is a simple indisputable fact that flies directly in the face of commonly accepted notions of democracy, populations have shown themselves easily conned into accepting it as natural and legitimate. The ruling ideology has become part of us.

One of the ways this has been accomplished is the misuse of key terms. A good example is in the name we give our socioeconomic system. We live not in an oligarchy of concentrated material power that the facts show to be the case, but rather in a benign ‘liberal democracy’. The ruse is exposed if we step back and examine what exactly it is that we’re being directed to accept with this term. I submit it is this patently false proposition:

Possessing nothing, the people rule.

Given the stark truth that by possessing nothing the people are inescapably subservient to the material power of a tiny minority and therefore can’t possibly rule, ‘liberal democracy’ is exposed as a deceptive term; deceptive because it misleads us into thinking things are other than what they actually are.

The problem is with the meaning of ‘liberalism’ so let’s examine it a little closer. An entire literature has been written on it and now is certainly not the place for an extended treatment. What I’d like to do, though, is to briefly highlight some insights from Ishay Landa’s thoughtful 2010 book The Apprentice’s Sorcerer: Liberal Tradition and Fascism for it helps illuminate what’s going on behind the scene.

Liberalism, Landa reminds us, was the socioeconomic doctrine used by the budding European bourgeoisie in the 17th through 19th centuries against the nobility. The bourgeoisie won that battle but upon taking hold of power, they predictably had to defend it against its ultimate existential opponent, the propertyless majority. “It must be borne in mind that the whole purpose of liberal civil society from a Lockean point of view was to shore up nascent capitalist property and production. The political aspect of liberalism, namely parliamentary and constitutional rule, far from being an autonomous sphere alongside the economic one, was entirely a function of capitalism, conceived at all times as fully subservient to it”. “Parliamentarism and the rule of law were thus from the very beginning not the liberal end itself, to be defined, say, in terms of guaranteeing political pluralism; rather, they were mere means to an end, that of protecting capitalism”.

“Political liberalism splits apart from economic liberalism and effectively undermines it, since the logical economic upshot of democracy is not capitalism but its antithesis, communism”. Landa draws an important link between economic liberalism and fascism, observing that “the bulk of Hitler’s anti-liberalism is underpinned by the conviction that political liberalism is incompatible with capitalism”. “To examine the ideology of the British imperialists is to find in it many parallels to the basic tenets of fascist and Nazi ideology”. “Fascists were socioeconomic liberals exasperated by the implications of political liberalism”. “This basic dictatorial instinct, putting capitalism above the law, or making it interchangeable with it, pertains to the very DNA of liberalism”.

Landa concludes that “an ideological scrutiny of liberalism cannot become truly radical if it merely promotes a collectivist stance to counter liberal individualism. What it actually calls for is a defense of the individual FROM liberalism”.

A crucial aspect of that defense is to dump ‘liberal democracy’ from our vocabulary. This is especially important today given the incessant misleading discourse contrasting so-called populism with liberal democracy. Landa and many philosophers across the political spectrum identify economic liberalism with capitalism and correctly note its incompatibility with democracy. But popular culture doesn’t incorporate this crucial insight and instead tends to treat capitalism and democracy as inseparably linked and almost identical. Successfully exposing capitalism and economic liberalism to the popular mind as the antithesis of democracy is a subversionary act that would expose the entire system to collapse.

But Landa and the left need to go further for liberalism isn’t the only problematic term in this debate. Capitalism itself is highly deceptive for it inappropriately evokes images of investment, finance, the protestant work ethic, and so on. The system, plain and simple, isn’t ‘liberal democracy’ and it isn’t ‘capitalism’ either. It’s oligarchy–the civilization spanning material power of a tiny minority against the great majority.

I liked the militarized uniforms the New York Yankees wore on Memorial Day as they nicely highlighted the symbiotic relationship between the pin stripes of Wall Street and the military means that sustain its power. The link isn’t widely appreciated these days so kudos to the Yankee design department! It would be a gigantic step toward truth, in fact, if the military took a lesson from the Yankees and put pin stripes onto their very own uniforms!

The problem with baseball’s military theme, though, is that it was Memorial Day, a day which should have been one in which we pause and honor the unlucky kids who were slaughtered in almost entirely unnecessary wars. The proper attire for this isn’t a military uniform, it’s a black armband.

Smedley Butler, a Congressional Medal of Honor winning Marine, had these words to say in the 1930’s and they’re just as relevant today.

WAR is a racket. It always has been.

It is possibly the oldest, easily the most profitable, surely the most vicious. It is the only one international in scope. It is the only one in which the profits are reckoned in dollars and the losses in lives… If you don’t believe this, visit the American cemeteries on the battlefields abroad. Or visit any of the veteran’s hospitals in the United States.

I spent thirty-three years and four months in active military service as a member of this country’s most agile military force, the Marine Corps. I served in all commissioned ranks from Second Lieutenant to Major-General. And during that period, I spent most of my time being a high class muscle-man for Big Business, for Wall Street and for the Bankers. In short, I was a racketeer, a gangster for capitalism.

I suspected I was just part of a racket at the time. Now I am sure of it. Like all the members of the military profession, I never had a thought of my own until I left the service. My mental faculties remained in suspended animation while I obeyed the orders of higher-ups. This is typical with everyone in the military service.

I helped make Mexico, especially Tampico, safe for American oil interests in 1914. I helped make Haiti and Cuba a decent place for the National City Bank boys to collect revenues in. I helped in the raping of half a dozen Central American republics for the benefits of Wall Street. The record of racketeering is long. I helped purify Nicaragua for the international banking house of Brown Brothers in 1909-1912. I brought light to the Dominican Republic for American sugar interests in 1916. In China I helped to see to it that Standard Oil went its way unmolested.

In its 2018 Summary of the National Defense Strategy of the United States, the Defense Department offers the following ‘bullet’ point: “Prioritize preparedness for war — Achieving peace through strength requires the Joint Force to deter conflict through preparedness for war.”

This idea can be traced at least back to the classical Roman adage “Si vis pacem, para bellum” — If you want peace, prepare for war. While too aggressive for many of us, common sense does tell us that in a Hobbesian world of ‘all against all’, survival requires a defense adequate to the threats. Most of us can agree — If you want peace, prepare an adequate defense.

The great problem with the US military strategy is that we don’t live in a Hobbesian world; we live rather in a post World War II regime of US hegemony in which nuclear weapons make it an absurdity to think any war could be won. The US seems intent on constructing a world that doesn’t exist and its strategy therefore is exactly wrong: if you want peace, prepare for peace. And US power is so great, it’s reasonable to think it could indeed move the world toward real peace via a process of verifiable global disarmament.

To those who will assert this is utopian nonsense, I’d respond by simply asking why our government isn’t even trying. Where’s the proposal? Lacking one and facing instead the blunt preparedness for war, the only reasonable conclusion is that our government’s true goal isn’t peace. What then is it?

Here’s three adages that I think sum it up.

If you want to rule the world, prepare for war.

If you want to distract your population from the harsh truths of an unjust system, prepare for war.

If you want to maintain employment without promoting domestic collectivism, prepare for war.

The US state is violently acting against the interests of the American people and humanity. It’s far past time Americans reject the warfare state and demand its government present good faith proposals for peace.

On what moral principle do the humans living north of the Rio Grande River refuse to let those living to the south entry onto the land they inhabit? The ‘first to arrive’ principle? Historically aware northerners might seek to avoid this line of attack. But even if we pretended the northerners preceded the indigenous and the Mexicans themselves, would they then have a morally viable position?

Perhaps they could turn to John Locke, the father of Anglo-American individualism, and assert a ‘natural’ right to own property. What’s often overlooked in this argument, though, is that Locke inserted a ‘proviso’ which requires there remain “enough, and as good left in common for others”. If the proviso fails, then there is no Lockean right to property. Sadly for the northerners’ wish to morally enjoy their property, the proviso in fact fails. It fails because of the substantial and centuries old interference in the affairs of Latin America by the power elite of the United States. Via the power of money and finance, military invasion, bribery, assassination, coups, and so on, US actions across all of Latin America have assured that a tiny oligarchy rules at the expense of an impoverished majority. American policy, in cahoots with local elites, deny the people enough and as good in common.

The right to a closed border can be morally justified only if the United States ceases to support the systemic rule of oligarchy and re-directs its efforts to the great cause of eliminating poverty and inequality around the globe. At that point, however, the question becomes moot as there’d be no need for a closed border.